$2,604,000 penalty… Failure of providing franchise disclosure document

$2,604,000 penalty… Failure of providing franchise disclosure document

“This outcome should be a strong reminder for franchisors to meet their disclosure obligations or face serious consequences.”

– ACCC Deputy Chair Mick Keogh

Introduction

In 2019, the Federal Court of Australia handed down a judgment in which the Australian Competition and Consumer Commission (ACCC) alleged that the franchisor Ultra Tune Australia Pty Ltd (Ultra Tune) had failed to provide accurate information regarding the price of the franchise, the ongoing rent of the premises, and the age of the franchise in the franchise disclosure documents they provided to prospective franchisees. As a result of this failure to comply with franchise disclosure compliance requirements, the court ordered a penalty of $2,604,000.

This article provides a direct insight into the statutory requirements in relation to the franchise disclosure document in Australia.

Franchise Disclosure Document Compliance in Australia

Investing in a franchise is an exciting opportunity for entrepreneurs looking to leverage an established brand and business model. However, it’s essential for potential franchisees to have access to comprehensive information that enables them to make informed decisions. This is where the franchise disclosure document comes in, playing a crucial role in providing a solid foundation for a successful franchise relationship.

A franchisor must provide franchisees and prospective franchisees with a disclosure document in accordance with Annexure 1 of the Competition and Consumer (Industry Codes – Franchising) Regulation 2014 (the Code). The disclosure document provides franchisees with useful and reliable information about the franchise, equipping them with the current knowledge necessary for the successful operation of their business.

The statements and representations made in the disclosure document must be true, accurate and able to substantiate. Any misleading or inadequately disclosed information may result in penalties imposed by the court or the Australian Competition and Consumer Commission (ACCC), which can issue infringement notices.

Generally, a franchisor must provide a potential franchisee with a copy of their disclosure document at least 14 days prior to the franchisee entering into the franchise agreement or making a non-refundable payment.

Franchisors must update their disclosure documents annually within four months of the end of the financial year. That is to say, for franchisors working on a standard July-to-June financial year, they should complete their update by the end of each October.

Boxes must be ticked!

As mentioned above, in Australia, the format of a disclosure document is prescribed by the Code, specifically in the form order of Annexure 1. Franchisors are required to adhere to this format, including the use of specified headings and numbering as outlined in Annexure 1 of the Code.

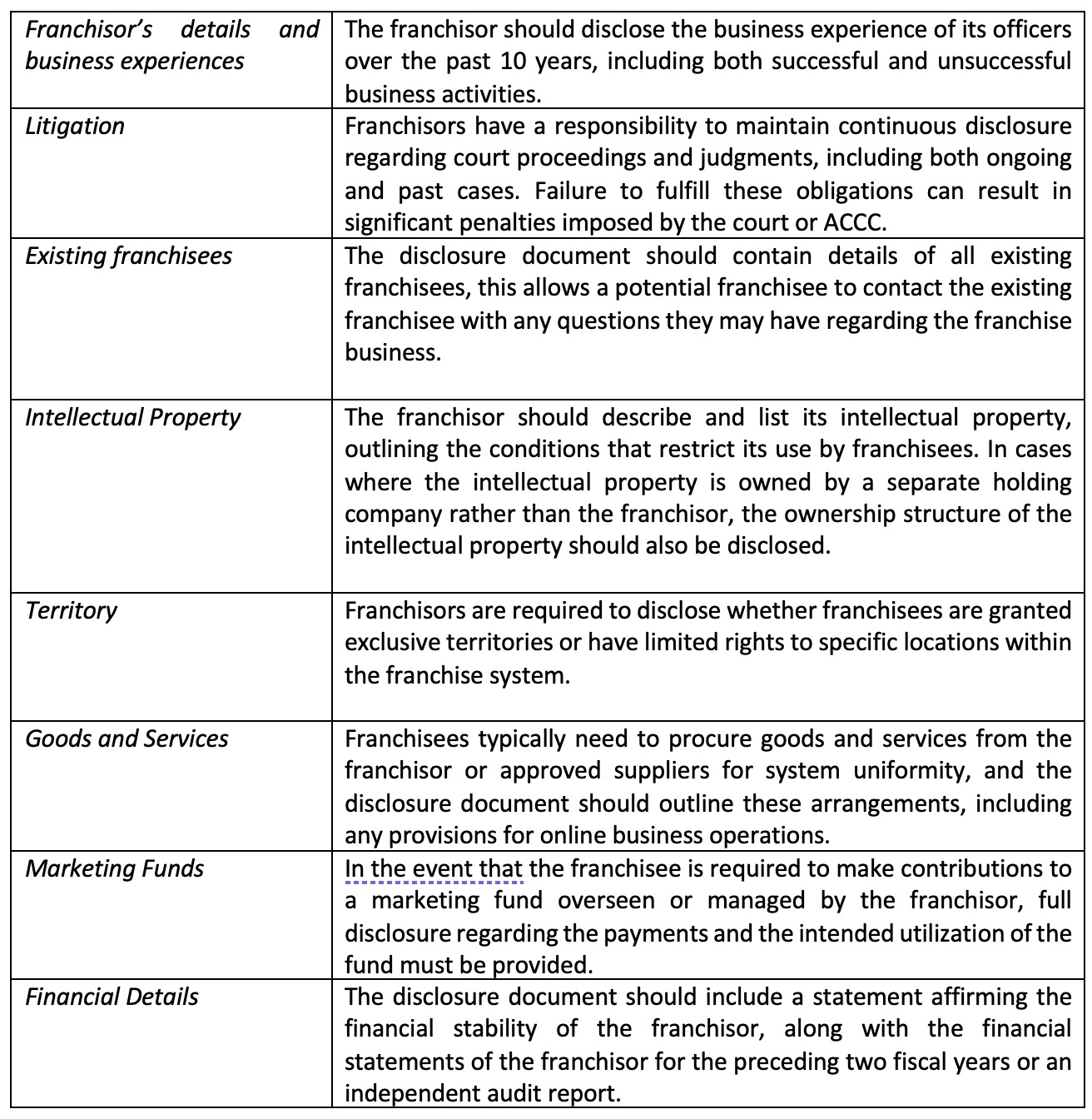

Some key elements in a disclosure document include:

Conclusion

The franchise disclosure document is essential for transparent information sharing with potential franchisees. Franchisors must ensure its accuracy, updates, and compliance with regulations, enabling prospective franchisees to assess risks and grasp the dynamics of their future franchisor-franchisee relationship.

If you require assistance with franchise business compliance, please contact us for more information.

Disclaimer:

This article does not give legal advice. It is intended to provide general information in summary form on legal topics, current at the time of first publication, for general information purposes only. The contents do not constitute legal advice, are not intended to be a substitute for legal advice and should not be relied upon as such. Formal legal advice should be sought in particular matters.

Relevant References:

- Competition and Consumer (Industry Codes–Franchising) Regulation 2014 – Schedule 1 http://classic.austlii.edu.au/au/legis/cth/consol_reg/caccr2014616/sch1.html

- Australian Competition and Consumer Commission v Ultra Tune Australia Pty Ltd [2019] FCA 12